The American Bankers Association routing numbers are solely used for ACH transfers. The ABA routing numbers are useful only for ACH transfers. Domestic wire transfers must only be completed through local ACHs within a day. In the country of the receiving bank, international wire transfers must also clear an ACH that adds to the procedure another day. Factors like holidays at banks, time zones, weekends, and mistakes in detail may delay wire transfer.

It is also essential that account numbers and bank codes be checked before a wire transfer is completed. SWIFT codes are used to identify banks and financial institutions worldwide. They are used by the swift network to transmit wire transfers and messages between them.

For international wire transfers, swift codes are always required in order to make transactions secure and fast. A SWIFT Code is a standard format of Bank Identifier Code used to specify a particular bank or branch. These codes are used when transferring money between banks, particularly for international wire transfers.

Banks also use these codes for exchanging messages between them. You can receive funds to your Wells Fargo Bank account from any bank within USA using domestic wire transfer. You need to provide the following details to sender of the funds who will initiate the domestic wire transfer through his/her financial institution. If you are looking for Wells fargo bank routing number for wire transfer, then you are at right place.

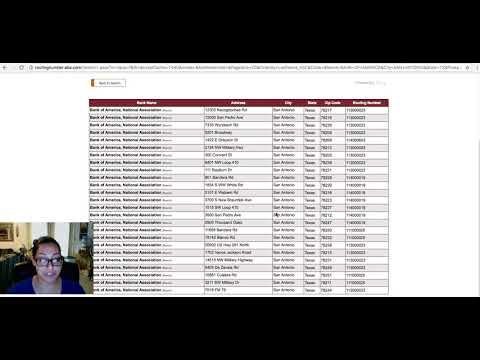

Here, we are going to full list of Wells fargo bank routing number with address. US banks use the same CHIPS and Fedwire systems to process international wire transfers. Instead, they send wire instructions using the Society for Worldwide Interbank Financial Telecommunications codes instead of the local bank routing number. SWIFT is a worldwide non-profit organization consisting of over 9,000 institutions.

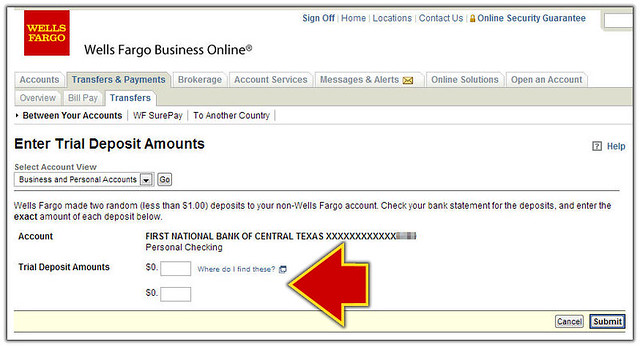

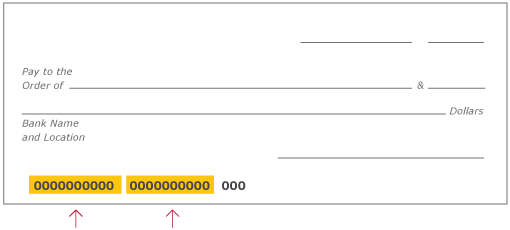

Usually, the exact routing number is close to the bottom of the cheque, where you can identify the financial institution in which it is designed. The check number, sometimes called the ABA number or SWIFT code, can manage an account and transfer money from one bank account to another. Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app.

For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. The routing number for domestic and international wire transfers for Wells Fargo are the same across all states. The checking and saving account routing number and the ACH routing number for Wells Fargo varies state by state, you can find these in the table above. International wire transfer is one of the fastest way to receive money from foreign countries. Banks use SWIFT network for exchanging messages required for performing international wire transfer. Usually, the receiving bank and the sending bank need to have a direct arrangement in place to start the swift transfer – this is sometimes referred to as correspondent banking.

Also known as banking routing numbers, routing transit numbers, RTNs, and SWIFT codes. Routing numbers are different from checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. Domestic wire transfers in the US, however, communicate transaction instructions through CHIPS or Fedwire networks. On the other hand, international wire transfers use SWIFT, a network of more than 10,000 banks and financial institutions across 200 countries.

A routing number is a nine digit code, used in the United States to identify the financial institution. Routing numbers are used by Federal Reserve Banks to process Fedwire funds transfers, and ACH direct deposits, bill payments, and other automated transfers. Routing numbers differ for checking and savings accounts, prepaid cards, IRAs, lines of credit, and wire transfers. All banks usually have separate routing numbers for each of the states in the US. Wells Fargo Bank Na A routing number is a nine digit code, used in the United States to identify the financial institution. Now you'll see the routing number for direct deposits, electronic payments, and domestic wire transfers.

A routing number, also called the ABA routing transit number , is a nine-digit code that indicates the financial institution you bank at. They are unique to each bank and allow the accurate transferring of money between financial institutions. A SWIFT code is used instead of a routing number for international wire transfers. Wire transfers are among the most prevalent methods of financial transfer between local and international banks.

Do people or companies interested in making such a transaction may inquire about the difference between domestic and international wire transfers? On this page - we've listed all the Wells Fargo routing numbers for checking accounts and wire transfers. You can also click through to a specific state if you want more information, or check out some other handy tips for finding your Wells Fargo routing number here. A routing number is a nine-digit numeric code printed on the bottom of checks that is used to facilitate the electronic routing of funds from one bank account to another. It's also referred to as RTN, routing transit number or bank routing number. We recommend using services like TransferWise for getting best conversion rates with lower wire transfer fees.

Wire transfer is the fastest mode of receiving money in your Wells Fargo Bank account. You can receive money from within USA or from a foreign country . The transaction is initiated by the sender through a financial institution, however and need to provide your banking details to the sender for successful transfer of money. International or domestic wire transfers both need a routing number. Incoming and outgoing international wire transfer costs depend on the provider, destination, transaction amount, and the mode of sending money. They can also cost more if you choose to use Wells Fargo's foreign currency exchange service.

Wire transfers are a faster way to send money than an ACH transfer. You can make a wire transfer by visiting a Wells Fargo branch. Wire transfers are "better" than ACH transfers because they are faster by a few days; nevertheless, wire transfers are also more expensive. An ACH transfer is entirely free, whereas an incoming wire transfer costs $15, and an outgoing transfer costs $30 per transaction. When you send a Fedwire wire transfer, your bank utilizes a 9-digit ABA routing number to identify the destination's bank.

Contrary to CHIPS, Fedwire transfers are nearly instantaneous. Once the recipient receives a notification, they can withdraw their cash. Is it time for you to open a bank account for your child? The best bank accounts for kids include features that help you teach them about money management, earning interest, and more. Here are the details regarding some of the best checking and savings accounts for getting your kids on the path to great money management in adulthood. On this page - We've listed the Wells Fargo routing number for checking accounts and wire transfers.

Routing numbers help identify banks when processing domestic ACH payments or wire transfers. You don't need one to make a payment to your friend in France, for example. Bank routing number is a 9 digit code which is necessary to process Fedwire funds transfers, process direct deposits, bill payments, and other such automated transfers.

We currently do not have a routing number for Wells Fargo Bank in our database. The routing number can be found at the bottom of the check. This same line will also contain the check number for the check in question. These three pieces of information are needed to give each check full and unique identification for purposes of moving money between accounts.

Try our online SWIFT/BIC lookup tool to locate any of the thousands active or passive swift codes. Our primary focus is to provide you with the most accurate and up to date database of financial institutions all over the world. You can search for an institution's detailed data by entity name, BIC, or even specific keywords that narrow the search results even more. You can also browse for swift codes by clicking on the list of countries and then choosing the institution's name from the alphabetical list. Monthly maintenance fee waived on one TD Simple Checking℠ account and any Savings and Money Market accounts.

Plus, get free standard check orders, money orders, official bank checks and stop payments. Likewise, credit cards do not have routing numbers since they are not directly linked to any bank account. Although your debit card is associated with a bank account, you do not use a routing number for debit card transactions.

Routing numbers are only used for transfers directly between bank accounts. Any transfer that takes longer cannot be regarded as a wire transfer. The extra delay is due to international processing systems rather than domestic automated clearing houses .

This number is important to transfer money to other accounts or money to pals. As several financial institutions have various routing numbers, it is crucial to ensure that you use the correct number before starting a transaction. Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app.

To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Boca Raton, Florida There are several routing numbers for Wells Fargo Bank, National Association reported in our bank database. Fort Lauderdale, Florida There are several routing numbers for Wells Fargo Bank, National Association reported in our bank database. Your routing number for Wells Fargo depends on the state in which you opened up your account.

It also varies based on the type of account, such as checking's account versus line of credit. Also, you would need to use a different routing number if doing a wire transfer. Using a Wells Fargo account in the US to send or receive a domestic or international wire transfer?

Make sure your payment arrives by using the right routing number. There is one routing number for Wells Fargo bank accounts in all branches in Florida. The same ABA routing number is used for both checking and savings accounts and is unique for Wells Fargo accounts in Florida. The ACH routing number will have to be included for sending an ACH transfer to any Wells Fargo bank account. To send a domestic ACH transfer, you'll need to use the ACH routing number which differs from state to state. Business Identifier Codes has been developed by Society for Worldwide Interbank Financial Telecommunication to identify banks and financial institutions globally.

That is why BIC Codes are also known as SWIFT Codes.SWIFT Codes / BIC Codes are used for transferring money between banks of different countries or SEPA payments. Banks also use these codes for exchanging financial messages. A routing number is a 9-digit code that is assigned to a bank or credit union so that it can make transactions with other financial institutions. It is used to route money transfers, such as check payments or direct deposits. Without it, they are dead in the water and cannot move funds.

Domestic wire transfers are run through either the Fedwire system or the Clearing House Interbank Payments System . Wire transfers are real time transfers and costs more than ACH transfer (which takes 2-4 days for transfer of money). Wells fargo bank has more checking account than other bank in united estate. SWIFT is a trademark owned by S.W.I.F.T. SCRL, which is headquartered at Avenue Adele 1, 1310 La Hulpe, Belgium. We are not in any way affiliated with S.W.I.F.T. SCRL and we are not the official source of SWIFT codes .

This site is focused on financial institutions around the world and information related to money transfers. Please visit the swift.com website for official information regarding BIC codes. You'll likely need your Wells Fargo routing number when managing your finances. Keep it handy should you need to set up a direct deposit, automatic payment, or wire transfer. SWIFT codes are the international equivalents of the US routing numbers. They direct the money to the correct bank for international transfers.

You can also save this page to your favorites if you want to come back and review what route number to use. CHIPS Participant0407Before sending a wire transfer, double-check that you have received all of the necessary information. Wire transfers are practically never reversible for a variety of reasons.

Always speak with the individual you are about to send a wire transfer to double-check the details and get their approval. I've heard of several scams that have occurred due to erroneous wire transfer transactions. US banks use the Interbank Payments System of Clearing House or the Fedwire to move cash locally through wire transfers. CHIPS operating regulations are established and facilitated by the New York Clearing House Association for transactions using the CHIPS system. Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts . We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account.

The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices. Wire transfers are "better" than an ACH transfer because they're faster by a few days – they're also more expensive. An ACH transfer is free, an incoming wire transfer costs $15 and an outgoing transfer costs $30. That means it is important to use the correct routing number, or your money can end up going to the wrong place.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.